The 10-Second Trick For Chapter 7 - Bankruptcy Basics

The 10-Second Trick For Chapter 7 - Bankruptcy Basics

Blog Article

Some Ideas on Tulsa Ok Bankruptcy Specialist You Need To Know

Table of ContentsThe 9-Minute Rule for Tulsa Bankruptcy Filing AssistanceTulsa Bankruptcy Attorney - An OverviewLittle Known Questions About Tulsa Bankruptcy Legal Services.The Greatest Guide To Chapter 7 Vs Chapter 13 BankruptcyThe Of Tulsa Bankruptcy Consultation

The stats for the various other primary type, Phase 13, are also worse for pro se filers. (We damage down the differences between the two kinds in deepness below.) Suffice it to state, speak with a lawyer or more near you who's experienced with personal bankruptcy legislation. Below are a few sources to discover them: It's reasonable that you could be reluctant to pay for an attorney when you're currently under significant economic stress.Many lawyers additionally offer totally free assessments or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is without a doubt the right selection for your scenario and whether they think you'll qualify.

Advertisement Now that you've chosen personal bankruptcy is indeed the right program of action and you with any luck removed it with an attorney you'll require to get started on the paperwork. Before you dive into all the official insolvency forms, you must get your very own files in order.

Tulsa Debt Relief Attorney Fundamentals Explained

Later down the line, you'll really need to prove that by divulging all kinds of info about your financial affairs. Here's a standard listing of what you'll need when traveling in advance: Determining documents like your vehicle driver's permit and Social Protection card Tax returns (as much as the previous 4 years) Proof of income (pay stubs, W-2s, freelance profits, income from possessions as well as any kind of revenue from federal government advantages) Bank statements and/or pension declarations Evidence of worth of your properties, such as vehicle and realty appraisal.

You'll want to understand what kind of financial debt you're trying to solve.

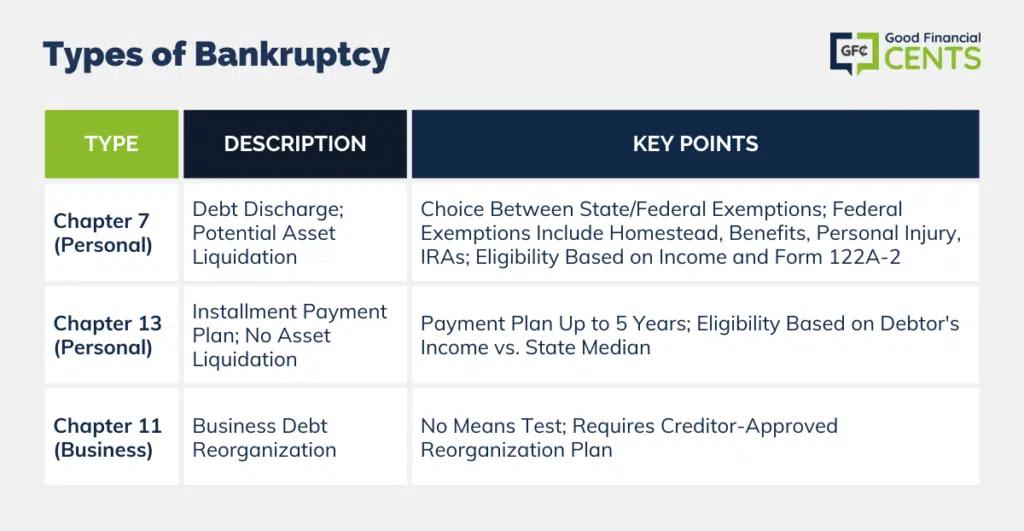

You'll want to understand what kind of financial debt you're trying to solve.If your revenue is expensive, you have another option: Phase 13. This choice takes longer to settle your debts Tulsa bankruptcy lawyer due to the fact that it needs a long-lasting repayment plan generally 3 to 5 years prior to several of your remaining debts are cleaned away. The declaring procedure is likewise a whole lot more complicated than Phase 7.

9 Easy Facts About Bankruptcy Law Firm Tulsa Ok Described

A Phase 7 insolvency remains on your credit history record for ten years, whereas a Chapter 13 personal bankruptcy drops off after seven. Both have lasting influences on your credit score, and any kind of new financial debt you secure will likely include greater rates of interest. Prior to you submit your insolvency types, you have to first finish a mandatory training course from a credit counseling firm that has actually been authorized by the Division of Justice (with the significant exemption of filers in Alabama or North Carolina).

The course can be finished online, in person or over the phone. You must finish the program within 180 days of declaring for bankruptcy.

Which Type Of Bankruptcy Should You File - Questions

Check that you're submitting with the correct one based on where you live. If your long-term home has actually moved within 180 days of loading, you must file in the district where you lived Tulsa bankruptcy attorney the greater section of that 180-day duration.

Normally, your insolvency lawyer will certainly work with the trustee, yet you might require to send the person files such as pay stubs, tax returns, and bank account and credit history card statements straight. A typical mistaken belief with personal bankruptcy is that when you submit, you can stop paying your debts. While bankruptcy can aid you clean out several of your unsecured debts, such as past due clinical bills or personal car loans, you'll want to maintain paying your regular monthly settlements for secured debts if you want to maintain the residential property.

The smart Trick of Chapter 7 Vs Chapter 13 Bankruptcy That Nobody is Discussing

If you're at risk of repossession and have actually exhausted all various other financial-relief alternatives, then submitting for Phase 13 may postpone the repossession and assist in saving your home. Ultimately, you will still need the income to continue making future home loan settlements, as well as paying off any type of late settlements over the program of your settlement plan.

The audit could postpone any kind of financial obligation relief by a number of weeks. That you made it this far in the procedure is a respectable sign at least some of your financial debts are qualified for discharge.

Report this page